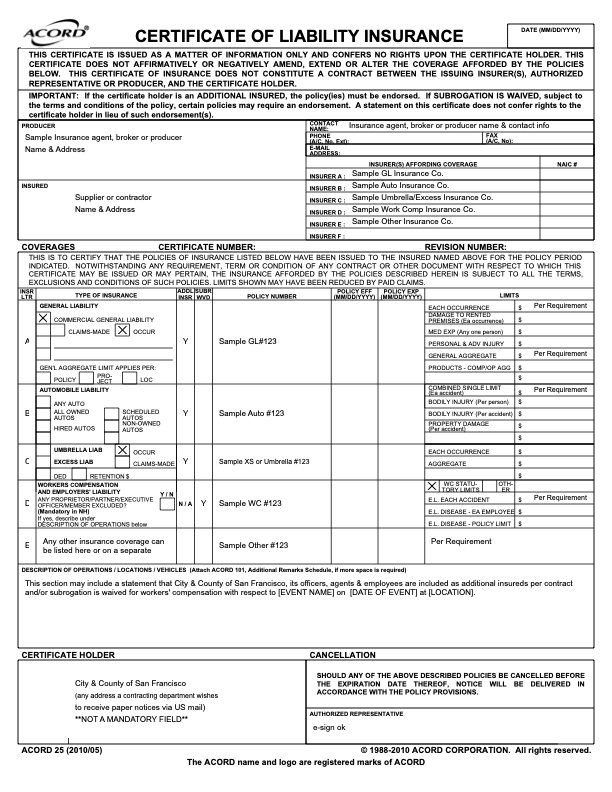

Here is an example of what a Certificate of Insurance looks like. Your insurance provider can send you this document, based on the requirements listed on this page.

City street closure

Insurance requirements

Street Fairs & Events in Entertainment Zones

- General Liability

- Not less than $500,000 each occurrence Combined Single Limit Bodily Injury and Property Damage, including Contractual Liability, Personal Injury, Broadform Property Damage, Products and Completed Operations Coverages

- Name "the City and County of San Francisco, its officers, agents, and employees" as Additional Insured

- Policy is the primary insurance to any other insurance available to the Additional Insureds with respect to any claims arising out of activities under the permit, and that insurance applies separately to each insured against whom claim is made or suit is brought.

- Automobile Liability, if applicable

- Not less than $500,000 each occurrence Combined Single Limit Bodily Injury and Property Damage, including owned, non-owned and hired auto coverages

- Worker's Compensation, if employees are hired for the event

- Not less than $500,000

Large events*

- Not less than $1 million, or more, if determined by the Office of Risk Management

*Large events are:

- More than 5 blocks

- More than 1,000 attendees

- Require rerouting of more than 3 Muni lines

- Sporting events with more than 50,000 people

- Parades

Exception for First Amendment activity (such as rallies, protests, or marches)

Insurance requirements can be waived by the Board of Supervisors if the applicant certifies in writing that:

- The purpose of the street fair is First Amendment expression, and

- The cost of obtaining insurance would be an "unreasonable prior restraint" on the right of First Amendment expression, or that it has been impossible for the applicant to obtain insurance coverage.

Exception for schools

- Temporary use or occupancy of a public street by a school where the school is using the street area for play purposes during specified hours of the school day.

City park event

Required insurance

- General liability insurance

- Not less than $2 million

- Name "the City and County of San Francisco and the Recreation & Park Department and its agents, employees and commissioners" in single limits applying to physical injury, property damage, and personal injury" as Additional Insured

Exception for First Amendment activity (such as rallies, protests, or marches)

If you're using a park for First Amendment activity, the City may waive insurance requirements if the cost of obtaining insurance would be an "unreasonable prior restraint" on the right of First Amendment expression, or that it has been impossible for the applicant to obtain insurance coverage.

Port events

Required insurance

- Comprehensive or Commercial General Liability

- $1-5 million, depending on nature of event

- Name the "City and County of San Francisco, the San Francisco Port Commission, and their Officers, Directors, Employees, and Agents" as Additional Insured

- Endorsement for Additional Insured and Waiver of Subrogation are required.

- Liquor Liability, if applicable

- Participants' insurance, if applicable

- Automobile Liability

- Not less than $1 million

- Worker's Compensation, if employees are hired for the event

- Not less than $1 million

Exception for First Amendment activity (such as rallies, protests, or marches)

If you're using the Port for First amendment activity, the City may waive insurance requirements if the cost of obtaining insurance would be an "unreasonable prior restraint" on the right of First Amendment expression, or that it has been impossible for the applicant to obtain insurance coverage.

Similarly, for First Amendment activities when a performance bond is required, the Port can accept property in lieu of a cash performance bond. The property has to be a type that would reasonably insure that the applicant would restore and clean the Port property.

Parades

Indemnification agreement required

- The applicant or sponsor of a parade permit must sign an agreement to reimburse the City and County of San Francisco for any costs incurred by it in repairing damage to City property which results from the actions of those sponsoring the event or authorized participants in the event, and to defend the City against and indemnify and hold the City harmless from any liability to any person which results from the actions of those sponsoring the event or authorized participants in the event.

- You must sign the agreement at least one week before the parade.

Treasure Island or Yerba Buena Island events

Insurance requirements

- General Liability

- Not less than $1 million each occurrence

- $2 million aggregate for bodily injury and property damage, including coverages for contractual liability, independent contractors, broad form property damage, personal injury, products and completed operations, fire damage and legal liability with limits not less than $1 million, explosion, collapse, and underground (XCU)

- Name “The Treasure Island Development Authority, City and County of San Francisco, and their officers, directors, employees and agents” as Additional Insured

- Policy is the primary insurance to any other insurance available to the Additional Insureds with respect to any claims arising out of activities under the permit, and that insurance applies separately to each insured against whom claim is made or suit is brought

- Automobile Liability, if applicable

- Not less than $1 million each occurrence combined single limit for bodily injury and property damage, including coverages for owned and hired vehicles and for employer’s non-ownership liability, which insurance shall be required if any automobiles or any other motor vehicles are operated in connection with the event

- Worker's Compensation and Employer's Liability, if employees are hired for the event

- Not less than $1 million for each accident, injury or illness, on employees eligible for each

- Based on the event, the Office of Risk Management may require more or different insurance coverage

Events requiring a Fire Department permit

Required insurance

All events

- General Liability Insurance

- Not less than $1 million each occurrence Combined Single Limit Bodily Injury and Property Damage, including Contractual Liability, Broadform Property Damage, Products, and Completed Operations Coverages

- Name "the City and County of San Francisco, its officers, agents, and employees" as Additional Insured

- Primary insurance to any other insurance available to additional insureds with respect to claims arising out of activities under the permit

- Worker’s Compensation Insurance, if employees are hired for the event

Events with explosives, explosive materials, fireworks, or pyrotechnics

- Commercial General Liability Insurance

- $2 million general aggregate

- Combined single limit for bodily injury and property damage, including coverage for Contractual Liability, independent contractors, Explosion, Collapse, and Underground (XCU), Personal Injury, Broadform Property Damage

- Name "the City and County of San Francisco, its officers, agents, and employees" as Additional Insured

Notes

The Fire Department may consult with San Francisco's Risk Manager and require a greater or lesser amount of insurance coverage. This will be decided based on the conditions at your event location.

For events that require Interdepartmental Staff Committee on Traffic and Transportation (ISCOTT) approval, you can submit your proof of liability insurance directly to ISCOTT.

The name of event organizer must match the name on the insurance and your permit application.